An examination of the claim that flash will replace hard drives in the data center

“Hard drives will soon be a thing of the past.”

“The data center of the future is all-flash.”

Such predictions foretelling hard drives’ demise, perennially uttered by a few vocal proponents of flash-only technology, have not aged well.

Without question, flash storage is well-suited to support applications that require high-performance and speed. And flash revenue is growing, as is all-flash-array (AFA) revenue. But not at the expense of hard drives.

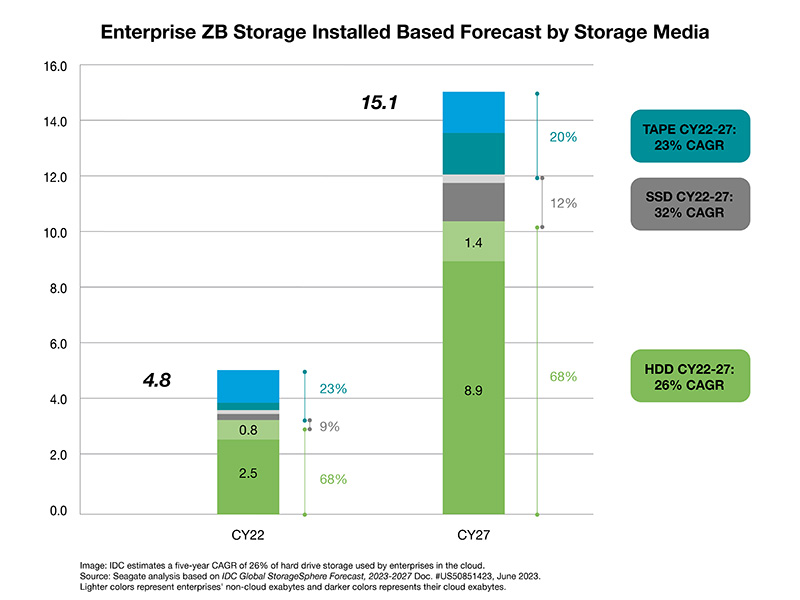

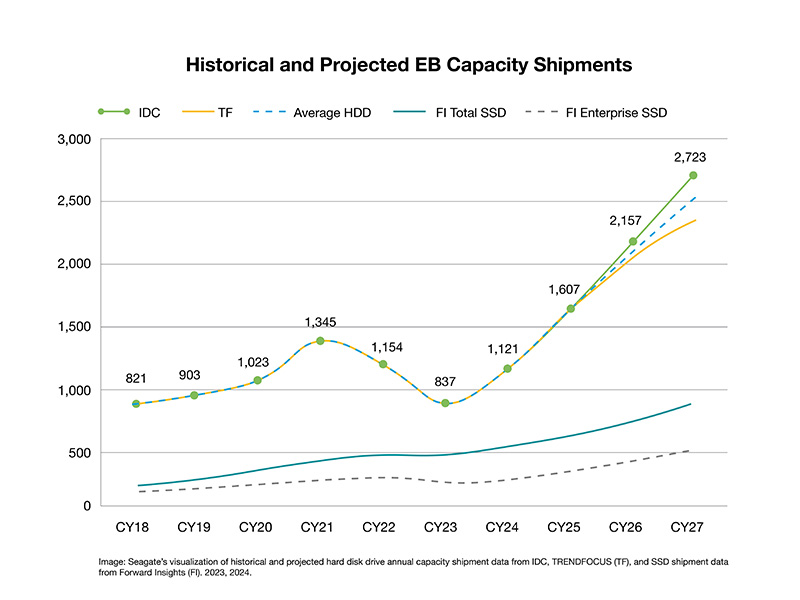

We are living in an era where the ubiquity of the cloud and the emergence of AI use cases have driven up the value of massive data sets. Hard drives, which today store by far the majority of the world’s exabytes (EB), are more indispensable to data center operators than ever. Industry analysts expect hard drives to be the primary beneficiary of continued EB growth, especially in enterprise and large cloud data centers—where the vast majority of the world’s data sets reside.

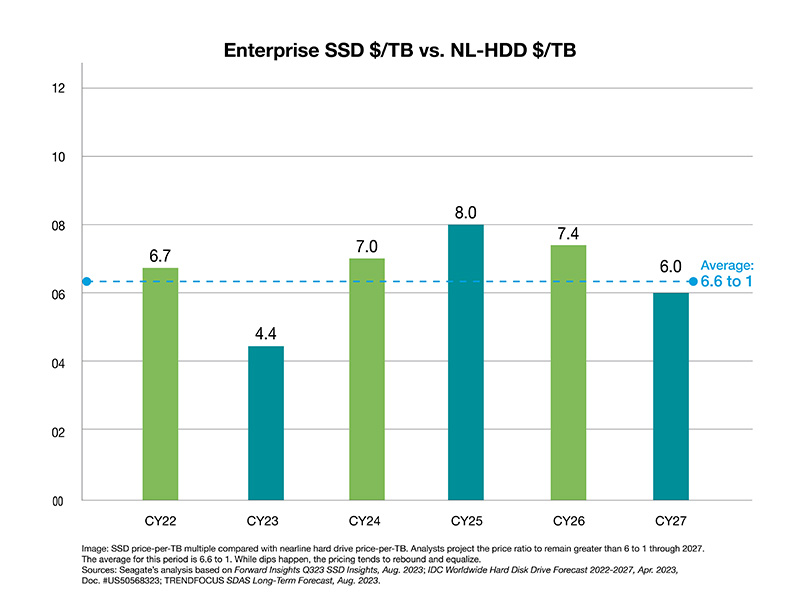

Myth: SSD pricing will soon match the pricing of hard drives.

Truth: SSD and hard drive pricing will not converge at any point in the next decade.

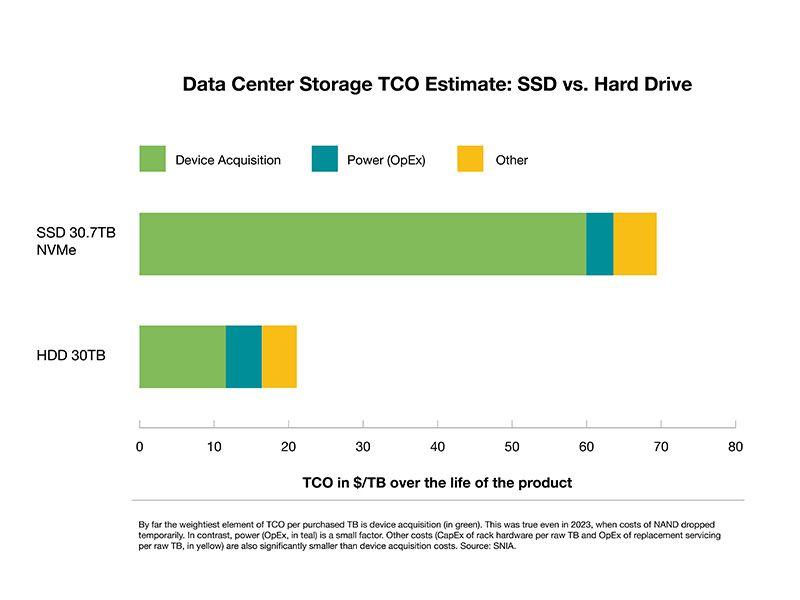

Hard drives hold a firm cost-per-terabyte (TB) advantage over SSDs, which positions them as the unquestionable cornerstone of data center storage infrastructure.

Analysis of research by IDC, TRENDFOCUS, and Forward Insights confirms that hard drives will remain the most cost-effective option for most enterprise tasks. The price-per-TB difference between enterprise SSDs and enterprise hard drives is projected to remain at or above a 6 to 1 premium through at least 2027.

This differential is particularly evident in the data center, where device acquisition cost is by far the dominant component in total cost of ownership (TCO). Taking all storage system costs into consideration—including device acquisition, power, networking, and compute costs—a far superior TCO is rendered by hard drive-based systems on a per-TB basis.

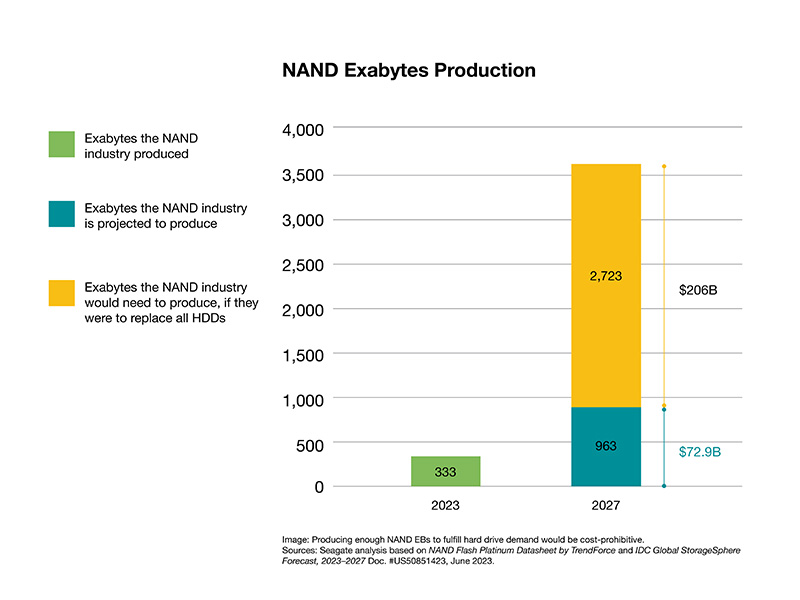

Myth: Supply of NAND can ramp to replace all hard drive capacity.

Truth: Entirely replacing hard drives with NAND would require untenable CapEx investments.

The notion that the NAND industry would or could rapidly increase its supply to replace all hard drive capacity isn’t just optimistic—such an attempt would lead to financial ruin.

According to the Q4 2023 NAND Market Monitor report from industry analyst Yole Intelligence, the entire NAND industry shipped 3.1 zettabytes (ZB) from 2015 to 2023, while having to invest a staggering $208 billion in CapEx—approximately 47% of their combined revenue.

In contrast, the hard drive industry addresses the vast majority—almost 90%—of large-scale data center storage needs in a highly capital-efficient manner. To help crystalize it, let’s do a thought experiment. Note that there are 3 hard drive manufacturers in the world. Let’s take one of them, for whom we have the numbers, as an example. Look at the chart below where byte production efficiency of the NAND and hard drive industries are compared, using this hard drive manufacturer as a proxy. You can easily see, even with just one manufacturer represented, that the hard drive industry is far more efficient at delivering ZBs to the data center.

Could the flash industry fully replace the entire hard drive industry’s capacity output by 2028?

Yole Intelligence report cited above indicates that from 2025 to 2027, the NAND industry will invest about $73 billion, which is estimated to yield 963EB of output for enterprise SSDs as well as other NAND products for tablets and phones. This translates to an investment of about $76 per TB of flash storage output. Applying that same capital price per bit, it would require a staggering $206 billion in additional investment to support the 2.723ZB of hard drive capacity forecast to ship in 2027. In total, that’s nearly $279 billion of investment for a total addressable market of approximately $25 billion. A 10:1 loss.

This level of investment is unlikely for an industry facing uncertain returns, especially after losing money throughout 2023.

Myth: Only AFAs can meet the performance requirements of modern enterprise workloads.

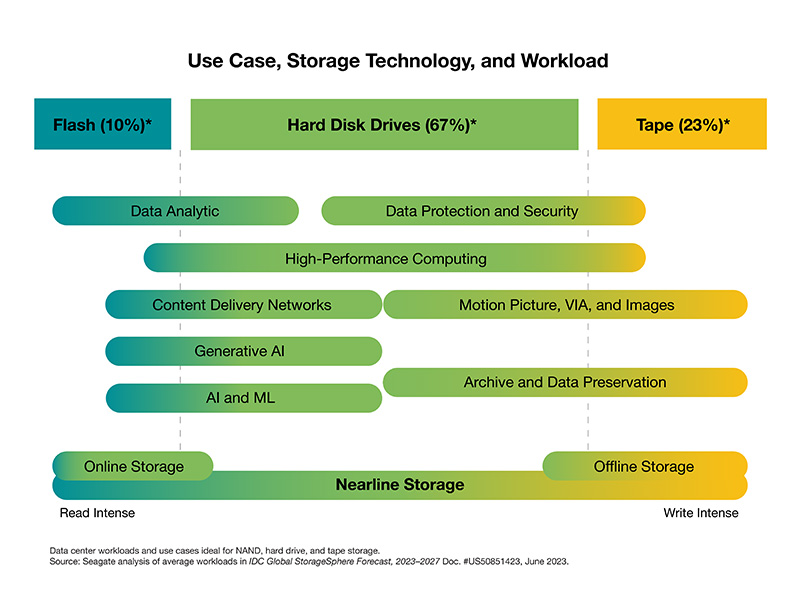

Truth: Enterprise storage architecture usually mixes media types to optimize for the cost, capacity, and performance needs of specific workloads.

At issue here is a false dichotomy. All-flash vendors advise enterprises to “simplify” and “future-proof” by going all-in on flash for high performance. Otherwise, they posit, enterprises risk finding themselves unable to keep pace with the performance demands of modern workloads. This zero-sum logic fails because:

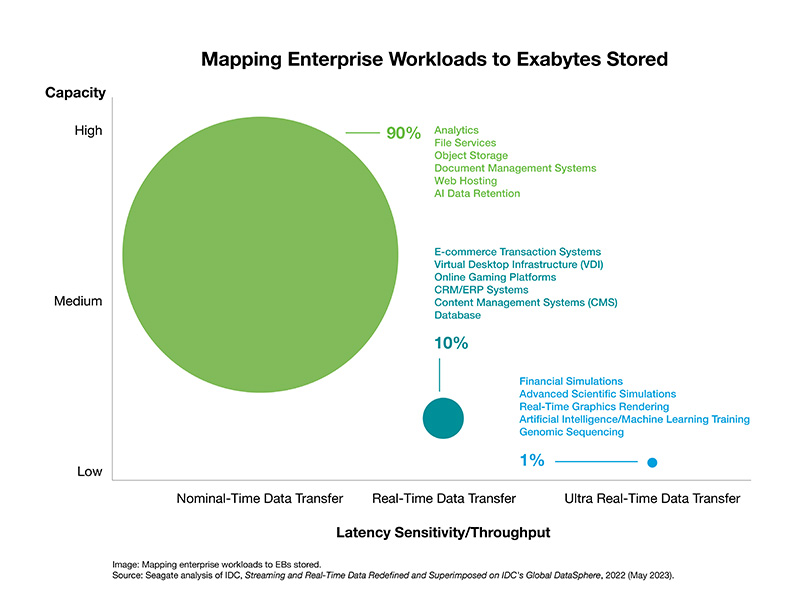

- Most modern workloads do not require the performance advantage offered by flash.

- Enterprises must balance capacity and cost, as well as performance.

- The purported simplicity of a single-tier storage architecture is a solution in search of a problem.

Let’s address these one by one.

First, most of the world’s data resides in the cloud and large data centers. There, only a small percentage of the workload requires a significant percentage of the performance. This is why according to IDC[1] over the last five years, hard drives have amounted to almost 90% of the storage installed base in cloud service providers and hyperscale data centers.

In some cases, all-flash systems are not even required at all as part of the highest performance solutions. There are hybrid storage systems that perform as well as or faster than all-flash.

Second, TCO considerations are key to most data center infrastructure decisions. This forces a balance of cost, capacity, and performance. Optimal TCO is achieved by aligning the most cost-effective media—hard drive, flash, or tape—to the workload requirement. Hard drives and hybrid arrays (built from hard drives and SSDs) are a great fit for most enterprise and cloud storage and application use cases.

While flash storage excels in read-intensive scenarios, its endurance diminishes with increased write activity. Manufacturers address this with error correction and overprovisioning—extra, unseen storage, to replace worn cells. However, overprovisioning greatly increases the imbedded product cost and constant power is needed to avoid data loss, posing cost challenges in data centers.

Additionally, while technologies like triple level cell (TLC) and quad-level cell (QLC) allow flash to handle data-heavy workloads like hard drives, the economic rationale weakens for larger data sets or long-term retention. In these cases, disk drives, with their growing areal density, offer a more cost-effective solution.

Third, the claim that using an AFA is “simpler” than adopting a mix of media types in a tiered architecture is a solution in search of a problem.

Many hybrid storage systems employ a well-proven and finely tuned software-defined architecture that seamlessly integrates and harnesses the strengths of diverse media types into singular units. In scale-out private or public cloud data center architectures, file systems or software defined storage is used to manage the data storage workloads across data center locations and regions. AFAs and SSDs are a great fit for high-performance, read-intensive workloads. But it’s a mistake to extrapolate from niche use cases or small-scale deployments to the mass market and hyperscale where AFAs provide an unnecessarily expensive way to do what hard drives already deliver at a much lower TCO.

The data bears it out. Analysis of data from IDC and TRENDFOCUS predicts an almost 250% increase in EB outlook for hard drives by 2028. Extrapolating further out in time, that ratio holds well into the next decade.

Hard drives, indeed, are here to stay—in synergy with flash storage. And the continued use of hard drives and hybrid array solutions supports, in turn, the continued use of SAS technologies in the infrastructure data centers.

About the Author

Jason Feist is senior vice president of marketing, products and markets, at Seagate Technology.

[1] IDC, Multi-Client Study, Cloud Infrastructure Index 2023: Compute and Storage Consumption by 100 Service Providers, November 2023

Wow what a great blog.

Amazing information thank you for sharing Jason feist.

I’ve been working in cloud storage for over 15 years, and our system was the first to deploy flash in cloud storage in 2011, using it for tiering. We are one of the top 3 cloud storage systems by capacity and for the last few years we’ve been analyzing the use of flash and deploying dedicated flash based storage services. Having storage use flash only would greatly simplify our systems, but the economics don’t support it. We monitor all storage media and their roadmaps very carefully, and we do not see a point where flash can take on more than about 10% of the data cost effectively. Most of the noise around replacing HDD with flash is coming from the flash industry. There is no one building Zetta scale systems that can consider flash as a primary store. Is just too expensive and will continue to be. We continue to monitor for any new technology that could displace HDD, but we have yet to find one.